Trusted Credit Unions Cheyenne: Personalized Banking and Exceptional Solution

Wiki Article

Unlock Exclusive Benefits With a Federal Cooperative Credit Union

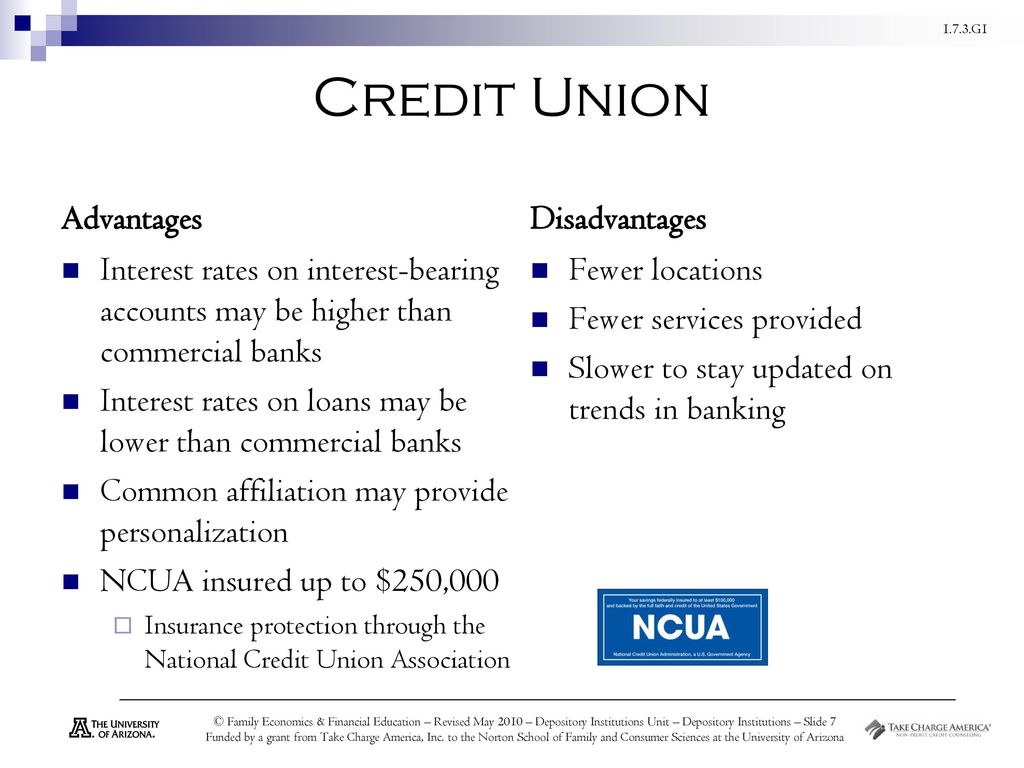

Federal Lending institution supply a host of special advantages that can substantially affect your economic wellness. From improved savings and examining accounts to lower rate of interest on lendings and customized monetary planning services, the advantages are tailored to help you conserve cash and attain your monetary goals much more effectively. But there's even more to these advantages than just financial perks; they can additionally provide a feeling of safety and security and area that surpasses traditional banking services. As we check out further, you'll uncover exactly how these distinct benefits can really make a difference in your economic journey.Membership Eligibility Standards

To come to be a participant of a federal credit score union, individuals need to fulfill certain eligibility standards developed by the organization. These standards vary depending on the specific cooperative credit union, yet they often consist of elements such as geographical location, employment in a certain market or company, membership in a particular company or association, or family connections to current members. Federal credit rating unions are member-owned economic cooperatives, so qualification requirements are in location to guarantee that individuals who sign up with share an usual bond or organization.

Enhanced Savings and Examining Accounts

With improved financial savings and checking accounts, federal credit history unions provide members premium monetary products made to maximize their cash administration techniques. In addition, federal credit rating unions usually provide online and mobile banking services that make it convenient for members to monitor their accounts, transfer funds, and pay expenses anytime, anywhere. By using these boosted savings and inspecting accounts, members can optimize their cost savings prospective and successfully handle their day-to-day finances.Lower Rate Of Interest Rates on Lendings

Federal cooperative credit union give members with the advantage of lower rates of interest on financings, enabling them to borrow cash at even more cost effective terms contrasted to various other banks. This benefit can result in significant cost savings over the life of a car loan. Lower interest prices imply that customers pay much less in rate of interest charges, reducing the overall expense of loaning. Whether members need a loan for an automobile, home, or personal expenditures, accessing funds with a federal credit scores union can lead to much more favorable repayment terms.Personalized Financial Preparation Solutions

Offered the concentrate on weblink improving members' financial well-being through lower rates of interest on car loans, federal debt unions additionally use personalized economic preparation services to assist people in achieving their lasting monetary objectives. These personalized solutions satisfy participants' particular demands and conditions, giving a tailored method to monetary preparation. By evaluating earnings, costs, liabilities, and assets, government credit rating union economic planners can assist members create a detailed monetary roadmap. This roadmap may include approaches for saving, spending, retirement preparation, and financial obligation administration.Additionally, the personalized economic planning solutions offered by government credit scores unions frequently come with a lower cost compared to private economic advisors, making them more easily accessible to a wider series of individuals. Participants can benefit from specialist advice and proficiency without sustaining high costs, aligning with the credit scores union viewpoint of focusing on participants' financial health. In general, these services aim to empower members to make informed economic decisions, build riches, and safeguard their economic futures.

Access to Exclusive Participant Discounts

Members of federal cooperative credit union take pleasure in exclusive access to a variety of participant price cuts on numerous services and products. Cheyenne Credit Unions. These discount rates are a beneficial perk that can help participants conserve cash on unique purchases and day-to-day costs. Federal credit rating unions often partner with retailers, company, and various other organizations to supply price cuts exclusively to their members

Members can take advantage of price cuts on a range of items, consisting of click for source electronic devices, garments, traveling bundles, and extra. Additionally, services such as automobile leasings, resort bookings, and home entertainment tickets might also be offered at affordable rates for lending institution participants. These exclusive price cuts can make a considerable distinction in participants' budget plans, permitting them to enjoy cost savings on both vital things and deluxes.

Verdict

Finally, joining a Federal Lending institution offers many advantages, consisting of enhanced cost savings and examining accounts, lower rate of interest on fundings, individualized monetary planning solutions, and accessibility to special participant price cuts. By coming to be a member, individuals can benefit from a series of financial benefits and services that can help them conserve cash, strategy for the future, and strengthen their ties to the regional area.

Report this wiki page